Not known Details About Feie Calculator

Table of ContentsRumored Buzz on Feie CalculatorThe Feie Calculator PDFsSome Known Incorrect Statements About Feie Calculator How Feie Calculator can Save You Time, Stress, and Money.Feie Calculator Things To Know Before You Get This

US expats aren't restricted just to expat-specific tax breaks. Frequently, they can claim a number of the exact same tax obligation credits and reductions as they would in the US, consisting of the Youngster Tax Obligation Credit History (CTC) and the Lifetime Learning Credit Report (LLC). It's feasible for the FEIE to decrease your AGI a lot that you don't get certain tax credit scores, though, so you'll require to double-check your qualification.

The tax code says that if you're an U.S. citizen or a resident alien of the United States and you live abroad, the IRS taxes your globally earnings. You make it, they exhaust it regardless of where you make it. You do obtain a nice exclusion for tax year 2024 - Digital Nomad.

For 2024, the optimal exemption has actually been raised to $126,500. There is additionally an amount of certified housing expenses eligible for exemption.

The Ultimate Guide To Feie Calculator

You'll have to figure the exemption initially, because it's restricted to your international gained income minus any kind of foreign housing exemption you declare. To qualify for the international made income exclusion, the foreign housing exclusion or the international real estate deduction, your tax obligation home should be in a foreign country, and you have to be one of the following: A bona fide citizen of an international nation for a nonstop duration that consists of a whole tax year (Authentic Homeowner Test).

If you proclaim to the international government that you are not a local, the test is not satisfied. Eligibility for the exemption could also be affected by some tax obligation treaties.

For United state residents living abroad or making income from international sources, inquiries usually occur on how the United state tax obligation system applies to them have a peek here and just how they can ensure conformity while decreasing tax obligation responsibility. From comprehending what international revenue is to browsing various tax obligation kinds and reductions, it is important for accountants to understand the ins and outs of United state

Our Feie Calculator Statements

Jump to Dive income is defined as specified income any kind of revenue sources outside resources the United States.

It's essential to differentiate international gained earnings from other kinds of international earnings, as the Foreign Earned Revenue Exclusion (FEIE), a useful united state tax advantage, particularly relates to this category. Investment income, rental earnings, and easy income from foreign sources do not receive the FEIE - Taxes for American Expats. These kinds of revenue might be subject to different tax obligation therapy

resident alien who is that citizen or person of nationwide country with nation the United States has an income tax revenue tax obligation effect and result is a bona fide resident of local foreign country international nation for nations uninterrupted period that duration an entire tax wholeTax obligation or A U.S. citizen or person U.S.

Foreign earned income. You have to have a tax home in a foreign nation.

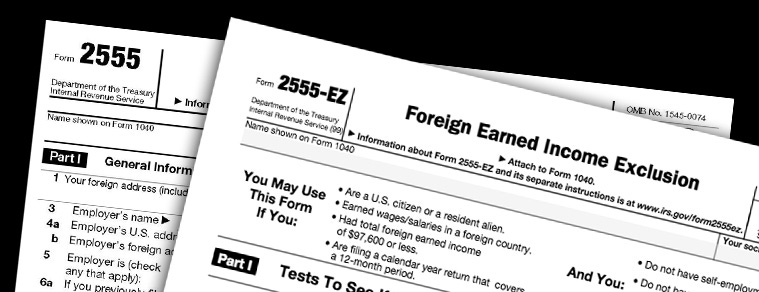

tax return for foreign income taxes paid to a foreign government. This credit can offset your U.S. tax obligation obligation on international income that is not eligible for the FEIE, such as investment earnings or passive income. To claim these, you'll first have to qualify (Bona Fide Residency Test for FEIE). If you do, you'll after that submit added tax obligation kinds (Kind 2555 for the FEIE and Kind 1116 for the FTC) and affix them to Form 1040.

Everything about Feie Calculator

The Foreign Earned Income Exemption (FEIE) allows qualified people to omit a part of their foreign earned earnings from U.S. taxation. This exemption can considerably minimize or eliminate the U.S. tax obligation responsibility on international income. Nonetheless, the specific amount of international earnings that is tax-free in the U.S. under the FEIE can change yearly because of rising cost of living adjustments.